Cash flow is an important part of any practice, no matter the age. However, the newer the practice, the more important cash flow. Especially as you scrape and claw to reach that "magic" break-even point. The sooner you break even, the sooner your practice is profitable and you start taking home a real paycheck! It also allows you to invest in your business—newer equipment, additional staff, marketing, and advertising.

Cash flow is an important part of any practice, no matter the age. However, the newer the practice, the more important cash flow. Especially as you scrape and claw to reach that "magic" break-even point. The sooner you break even, the sooner your practice is profitable and you start taking home a real paycheck! It also allows you to invest in your business—newer equipment, additional staff, marketing, and advertising.

One of the key pieces of cash flow for your practice is billing. And since most practices rely on insurance payouts for 30-40% of their revenue, this means ensuring you have an efficient and thorough process for insurance claims cannot be overlooked. How do claims work in your practice? Do you have a written process for submission and follow-up? Have you set up EFT with each payer to reduce the time for payment? Let's look at some of the details of insurance claims and attachments and how that directly impacts your cash flow.

Each claim has it's own "lifecycle": this is the journey a claim takes from being submitted to getting paid. Part of this lifecycle is under your control: how the claim is submitted and your follow-up process. However, there's a major portion of the lifecycle that puts you at the mercy of the payer. And each payer has it's own timeline for processing and paying the claim. To streamline the payment, you have to ensure that your part of the claim is processed efficiently and correctly.

Some payers and claims can take up to 60 days from submission to payment. That's a long time to wait in your cash flow cycle.

The key to a good claims process is to be streamlined and documented. It should be the same every time, no matter who is doing the claim. From the claim information to attachments, notes, x-rays and more, the submission should be the same. You should also have a process in place for following up and checking on payments. Was there an error in the submission? Is something missing? Your office needs to be proactive in order to reduce the time to pay. If there are errors that need correcting or resubmission, you need to know as soon as possible. You don't want to have to start the 60 days over again!

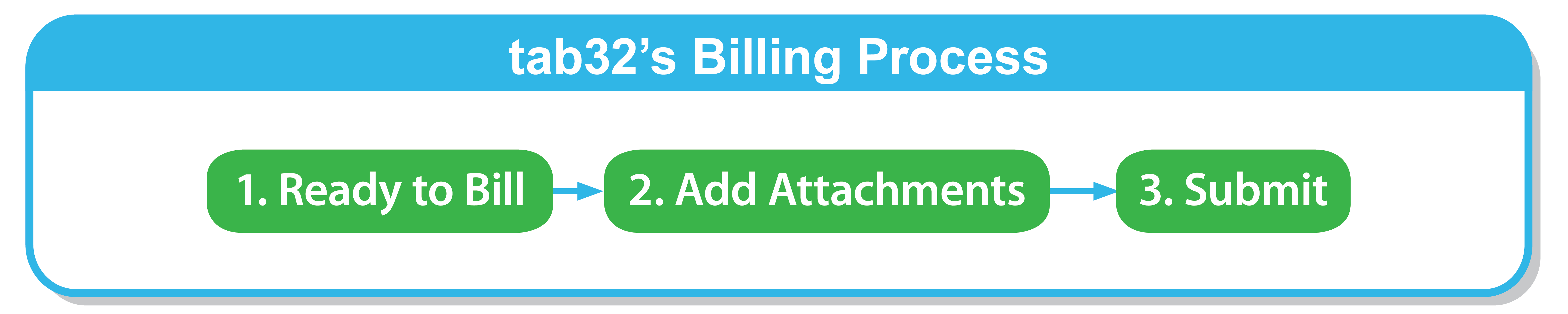

With tab32, we've made the insurance claim process super simple. It's only three steps! This not only makes it easy to replicate, it reduces the chance for error.

The more errors in your claims, the slower your processing time and the longer the payment will take. When you're already often waiting two months for claims to be paid, adding extra time can be a killer to your cash flow. Let's say your submission error rate is 5%. That's 5% more time for your staff that you have to cover in admin costs, plus the time waiting for the money to come in. Then, multiply that by 12 months! That's a lot of wasted admin time and huge gaps in your cash flow. We shouldn't have to tell you that your error rate should be ZERO. Like we mentioned above, there's a part of the process you can control—this is it and it needs to be flawless.

Our last tip is ensuring you have EFT set up with each payer. Each one will have to be done separately. But once you do it, you don't have to rely on or wait for paper checks and the mail for your payments. This is just one more step in the process that can get hung up and cause problems for your cash flow.

By using tab32, you can streamline your claims and follow-up process while

These Stories on Patient Engagement Software

No Comments Yet

Let us know what you think